Daily Current Affairs 16th September 2025

Daily Current Affairs 16th September 2025

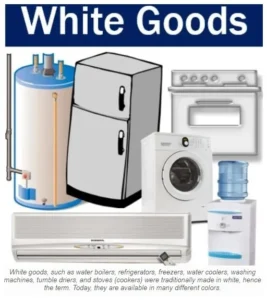

PLI Scheme for White Goods

Recently, the government has re-opened the application window for the production-linked incentive (PLI) scheme for white goods.

About PLI Scheme for White Goods –

- It is designed to create a complete component ecosystem for Air Conditioners and LED Lights Industry in India and make India an integral part of the global supply chains.

- It is implemented as a pan India scheme and is not specific to any location, area or segment of

- Objectives — It proposes a financial incentive to boost domestic manufacturing and attract large investments in the White Goods manufacturing value chain.

- Its prime objectives include removing sectoral disabilities, creating economies of scale, enhancing exports, creating a robust component ecosystem and employment generation.

- Incentives — The scheme will extend an incentive of 4-6% on incremental turnover over base year (2019-20) of goods sold in India and exported to global markets, to eligible companies for a period of 5 years.

• Eligibility —

- Applicant can be any company that should be incorporated in India under the provisions of the Company Act, 2013.

- Eligibility shall be subject to the achievement of thresholds of net incremental sales of Eligible Products for the respective financial year over the base year and cumulative incremental investment in the preceding financial year.

- Any entity availing benefits under any other PLI Scheme of Govt. of India will not be eligible under this scheme for the same

- Time period — It is to be implemented over FY 2021-22 to FY 2028-29

- Nodal Ministry — The scheme was notified by the Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce and Industry.

Presidential Reference

The Supreme Court has reserved its opinion on the Presidential reference under Article 143(1) of the Constitution concerning the powers of the President and Governors in granting assent to Bills. The reference comes after the SC’s ruling (April 2025) that held Tamil Nadu Governor R. N. Ravi’s delay in assenting to 10 Bills unconstitutional, invoking Article 142 to enforce assent and prescribing timelines.

This development raises fundamental issues of federalism, separation of powers, and judicial review in India’s constitutional framework.

Nature of the Reference –

- Presidential reference under Article 143(1) — It enables the President to seek SC’s opinion on questions of law/fact of public importance.

- States’ argument — The reference is an indirect appeal against the SC’s ruling, violating stare decisis – review lies only before the same Bench.

- Centre’s argument — The court’s advisory jurisdiction under Article 143 is distinct, and could be used to clarify constitutional doubts, even if past rulings existed.

- Past practice — SC has earlier refused to answer Presidential

Governor’s Powers – Aid and Advice vs. Discretion –

- States’ stance —

- The governor is bound by the aid and advice of the Council of Ministers (Article 163).

- Governance must reflect popular mandate, not the Governor’s

- Historical rulings of SC have restricted the Governor’s role to avoid

• Centre’s stance —

- The governor is not a “postman” or “showpiece.”

- Discretionary powers exist in exceptional circumstances

- Example: A 2004 Punjab law unilaterally terminated a tripartite river-water sharing treaty, highlighting the importance of a Governor’s discretionary powers. The SC in 2016 declared the law unconstitutional.

- Data (from 1970 to the present): Only 20 out of 17,000 bills were withheld by Governors, with 90% granted assent within the first month.

Governor’s Veto and “Pocket Veto” –

- SC’s ruling (State of TN vs Governor of TN case) — Governor cannot indefinitely withhold assent, concluding that a Governor cannot exercise a “pocket veto” over the elected

- Centre’s argument — Withholding assent means the Bill lapses, citing the Government of India Act 1935 as precedent, where the Governor’s “initial withholding was an absolute veto.”

- States’ rebuttal — Governors are not colonial-era Viceroys – such discretions were consciously omitted in the Constitution.

Judicial Enforcement of Timelines –

- SC ruling — Introduced timelines for assent to prevent

• Centre’s objection —

- Timelines amount to judicial amendment of the

- The Constituent Assembly rejected fixed timelines, replacing a six-week limit with the phrase “as soon as possible” in Article 200.

- Impasses should be resolved politically through dialogue between the state and the Governor, rather than the court acting as a “judicial headmaster”.

• States’ argument —

- “As soon as possible” implies urgency.

- The timelines in the April 2025 ruling did not specify when automatic assent would take place; rather, they specified when judicial review would be available.

Fundamental Rights and Writ Jurisdiction –

- Centre’s position — States cannot invoke Article 32, meant for fundamental rights of

• States’ counter —

- Governors act as links between Union and

- Denying writ remedy to states weakens federal

- Even Andhra Pradesh (where the ruling party is a coalition partner in the Centre) defended states’ right to move SC.

Larger Constitutional and Political Implications –

- Executive judiciary — The reference has become a flashpoint testing limits of judicial review over executive action.

- Polyvocal court challenge — Whether a 5-judge Bench will reaffirm or differ from the 2-judge ruling of April 2025.

- Federalism at stake — Opposition-ruled states back judicial intervention; Centre resists

- Impact on democratic governance — Issue of whether Governors’ discretionary power can override popular will of elected legislatures.

Way Forward –

- Clarity on Governor’s role — A constitutional definition of timelines and scope of discretion is necessary to prevent misuse.

- Strengthening federalism — Balance must be maintained between Union authority and state

- Judicial prudence — SC must respect separation of powers but ensure constitutional morality is upheld.

- Political dialogue — State–Centre–Governor coordination mechanisms need strengthening to avoid judicialisation of governance.

- Long-term reform — Consideration of a constitutional amendment or codification of Governor’s functions to prevent recurring disputes.

Conclusion –

In essence, the Presidential reference will determine how India negotiates the delicate balance between federalism, constitutional conventions, and judicial oversight.

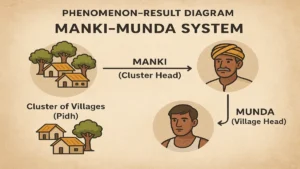

Manki-Munda System

Recently, adivasis of the Ho tribe in Jharkhand’s West Singhbhum protested against the Deputy Commissioner, alleging interference in their traditional Manki-Munda self-governance system after the removal of village heads (Mundas).

While the district administration clarified that Mankis and Mundas remain integral to the revenue framework and blamed rumours on social media for the unrest, tribal concerns over losing autonomy persist.

The episode threatens the century-old equilibrium between indigenous governance structures and the state administration in Jharkhand’s Kolhan region.

Traditional Manki-Munda Governance –

- For centuries, the Ho tribe of Jharkhand’s Kolhan region followed a decentralised governance system rooted in social and political responsibilities.

- Each village was led by a Munda, the hereditary village head who resolved local

- Groups of 8–15 villages, known as a pidh, were overseen by a Manki, who handled cases unresolved at the village level.

- Importantly, the Manki-Munda system dealt only with internal governance, having no role in revenue or land matters, nor any concept of taxes or external sovereign authority.

- This changed with the arrival of the East India Company, which introduced

British Intervention and Co-option of the Manki-Munda System –

- Following victories at Plassey (1757) and Buxar (1764), the East India Company gained diwani rights in 1765, enabling tax collection across Bengal, Bihar, Odisha, and Jharkhand.

- The Permanent Settlement Act of 1793 empowered zamindars with land deeds and fixed revenue demands, often beyond their capacity.

- To meet targets, zamindars seized Ho lands in Kolhan, sparking adivasi uprisings like the Ho revolt (1821–22) and the Kol revolt (1831).

- After repeated military failures, the British adopted a strategic compromise — formally recognising and co-opting the Manki-Munda system into their administration.

Wilkinson’s Rules and Their Lasting Impact –

- In 1837, the British appointed Captain Thomas Wilkinson as Political Agent in the Kolhan Government Estate (KGE) to manage the Ho-dominated region.

- Recognising the strength of local governance, Wilkinson drafted 31 “Wilkinson’s Rules” in 1833, formally codifying the Manki-Munda system for the first time.

- While appearing to preserve tribal autonomy and restrict outsiders (dikkus), the rules effectively co-opted community leaders as agents of British authority, integrating Kolhan into colonial

- This shift triggered major changes: the influx of outsiders surged from 1,579 in 1867 to 15,755 by 1897, aided by the railways, creating demographic shifts.

- Equally transformative was the introduction of private property — Mundas and Mankis became raiyats (tenants), receiving land deeds (pattas).

- This altered collective traditions of landholding, fostering individual ownership and reshaping Ho

Continuation of Wilkinson’s Rules –

- Although the Kolhan Government Estate was dissolved after Independence in 1947, Wilkinson’s Rules remain in force, with Kolhan exempted from India’s general civil procedure laws.

- Courts upheld their validity for decades, until the Patna High Court in Mora Ho vs State of Bihar

(2000) ruled they were old customs, not formal law — yet allowed them to continue in the absence of alternatives.

- Despite calls to update the system, neither Bihar nor Jharkhand took

- A 2021 Jharkhand initiative, Nyay Manch, was proposed but never enacted, leaving Wilkinson’s Rules still operational today.

The Current Conflict in Kolhan –

- The recent unrest in West Singhbhum stems from complaints by Scheduled Castes and OBCs in Ho-dominated villages.

- Issues included Mundas restricting the Gope community from pursuing non-traditional livelihoods and prolonged absences of village heads, which hindered access to official

- In response, the district administration issued a nine-point directive reminding Mundas of their duties under Wilkinson’s 1837 Hukuknama, aimed at ensuring transparency in the Manki-Munda

- However, villagers misinterpreted this as interference, sparking rumours of action against Mankis and Mundas.

- The administration has clarified that it does not intend to override customary

Larger Issues with the Manki-Munda System –

- In West Singhbhum, 1,850 Manki-Munda posts exist, with 200 vacant, of which 50 were recently filled via Gram Sabhas.

- However, concerns remain. Some roles have reportedly been given to non-tribal raiyats, bypassing the village system, sparking discontent.

- Within the Ho community, especially among youth, there are growing demands for reforms — including ending the hereditary nature of Munda roles and allowing non-tribal raiyats participation.

- Hereditary succession often leaves leadership in the hands of individuals lacking formal education, creating challenges in managing today’s document-driven administration.

- As a result, villagers frequently escalate unresolved issues to the district

- Many leaders note that while the Deputy Commissioner’s role is limited, it is crucial in clarifying provisions of Wilkinson’s Hukuknama and intervening in disputes or succession issues.

- Many argue the system should be preserved but modernised to align with democratic

Guidelines on DNA Evidence

In Kattavellai @ Devakar v. State of Tamil Nadu, the Supreme Court mandated strict protocols for DNA evidence in criminal cases.

It directed all State DGPs to prepare Chain of Custody Register forms and related documentation, and circulate them to all districts with clear instructions to ensure the integrity and reliability of DNA samples.

Need for Uniform DNA Handling Guidelines –

- In the Kattavellai @ Devakar case, involving rape, murder, and robbery, the Supreme Court found serious lapses, including unexplained delays in sending vaginal swab samples to the Forensic Science Laboratory and failure to establish a clear chain of custody.

- These gaps raised the possibility of contamination. The Court noted that while some bodies had issued guidelines, there was neither uniformity nor a common procedure across states.

- Given that ‘Police’ and ‘Public Order’ fall under the State List, the Court still found it essential to issue uniform directions to ensure consistency and reliability in DNA evidence handling

Supreme Court’s Guidelines on Handling DNA Evidence –

- The Supreme Court laid down four key guidelines to ensure the integrity of DNA evidence in criminal cases.

- First, DNA samples must be collected with due care, properly packaged with FIR details, case particulars, and duly documented with signatures of the medical professional, investigating officer, and independent witnesses.

- Second, the investigating officer must transport the samples to the concerned police station or hospital and ensure they reach the Forensic Science Laboratory within 48 hours; any delay must be explained with preservation measures taken.

- Third, once stored, samples cannot be opened, altered, or resealed without trial court

- Finally, a Chain of Custody Register must be maintained from collection until conviction or acquittal, appended to the trial record, with the investigating officer accountable for any lapses.

Supreme Court’s Rulings on DNA Evidence –

- The Supreme Court has consistently stressed that DNA evidence, though powerful, must meet strict standards of collection and handling.

- In Anil State of Maharashtra (2014), it upheld DNA profiling as valid and reliable, provided laboratory procedures maintain quality control.

- In Manoj v. State of Madhya Pradesh (2022), a DNA report was rejected due to contamination risk from recovery in an open area and insufficient, degraded blood samples.

- Similarly, in Rahul State of Delhi (2022), DNA evidence was discarded because it remained in police custody for two months, raising suspicion of tampering.

- In the Devakar case, the Court emphasised that quality control outside laboratories — in collection, sealing, and timely dispatch — is as critical as lab procedure.

- Thus, both investigating agencies and forensic experts must ensure rigorous safeguards to maintain credibility of DNA evidence.

Importance of DNA Evidence in Criminal Cases –

- DNA, derived from biological materials like blood, bone, semen, saliva, hair, or skin, helps establish whether a crime scene sample matches a suspect.

- While such matches can strongly indicate common biological origin, the Supreme Court in the Devakar case clarified that DNA is only opinion evidence under Section 45 of the Evidence Act (now Section 39 of the Bharatiya Sakshya Adhiniyam, 2023).

- Its probative value depends on the circumstances of each case. Thus, DNA evidence is significant but not conclusive, and must be scientifically validated and legally established to hold weight in criminal proceedings.

Conclusion –

The Supreme Court’s guidelines on DNA evidence aim to ensure reliability, prevent contamination, and strengthen criminal justice. Their success depends on consistent enforcement by police and forensic agencies.

Koala

Recently, Australia approved the world’s first vaccine to save koalas from Chlamydia.

About Koala –

- Koala bear (Phascolarctos cinereus) is an arboreal herbivorous marsupial native to

- It is the only extant representative of the family Phascolarctidae and its closest living relatives are the wombats.

- Koalas are asocial animals, congregating only during the breeding

- They spend most of their time eating and sleeping in eucalyptus trees, and their paws have two opposing thumbs to help them grasp and climb up tree trunks.

- Habitat — They can be found in habitats ranging from relatively open forests to woodlands, and in climates ranging from tropical to cool temperate.

- Distribution — Koalas are distributed across eastern and southeastern Australia, including northeastern, central, and southeastern Queensland, eastern New South Wales, Victoria as well as southeastern parts of South Australia.

- Food — Koalas are herbivorous (folivorous) animals, feeding primarily upon the leaves of the eucalyptus tree.

- Conservation status — IUCN: Vulnerable

- Threats — These species are facing compounded threats from disease, habitat loss, climate change and road collisions.

Chlamydia in koalas –

- Koalas suffer from both bacterium species Chlamydia pneumonia and Chlamydia

- The disease occurs in koalas multiple ways, including through mating, infected discharges and at birth.

- It can cause eye infections, blindness, urinary tract problems, and even

- Infected koalas often become weak, dehydrated, and more vulnerable to predators and

- In some areas of Australia, up to 70% of wild koalas carry the

- Chlamydia spreads quickly in koalas because they live in overlapping territories and groom each

International Electrotechnical Commission

India will host the 89th General Meeting (GM) of the International Electrotechnical Commission (IEC) from 15 to 19 September 2025 at Bharat Mandapam, New Delhi.

About International Electrotechnical Commission –

- It is a nonprofit organisation which was established in

- It is the organisation that prepares and publishes international Standards for all electrical, electronic and related technologies.

- IEC’s mission is to promote, through its members, international cooperation on all questions of electrotechnical standardisation and related matters.

- Its standards are developed in a consensus process by experts from the participating

- IEC Standards are often used as a basis to globally harmonise technical requirements in IEC

member and non-member countries.

- IEC standards reach over 150

- Standardisation Management Board (SMB) is an apex governance body of IEC responsible for technical policy matters.

- The IEC works closely with the International Organisation for Standardisation (ISO) and the International Telecommunication Union (ITU).

- It is the world’s leading body for developing international standards for electrical, electronic and related technologies, with a network of 30,000 experts worldwide.

- It is the fourth time India is hosting the prestigious IEC General Meeting, after 1960, 1997 and

- It is headquartered in Geneva,

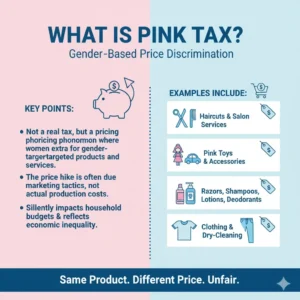

While there are no specific laws in India to address the issue of Pink Tax, the National Consumer Disputes Redressal Commission ruled that companies must follow fair pricing policies and avoid gender-based price discrimination.

About Pink Tax –

- The Pink tax is neither a real tax nor is it a government-imposed

- It is a term used to describe the extra cost that some companies charge for products marketed to women compared to similar products marketed to men.

- This means women might end up spending more money for the same product that men get for less.

- When companies charge more for pink (female) products compared to blue (male) versions, the extra revenue does not go to the government but benefits the companies

- Pink toys, haircuts, dry cleaning, razors, shampoos, body lotions, deodorants, facial care, skincare items, beauty care, clothing, T-shirts, jeans, salon services ,etc. suffer the tax.

- The term “Pink Tax” is believed to have originated in the S. in California in 1994.

- It emerged following the realisation that brands in various cities consistently charged women higher prices for goods and services than men.

- As per a study done in the U.S., personal care products targeting women were 13% costlier than men’s. Further, women’s accessories and adult clothing were 7% and 8% more

- Pink Tax in India —

- The “pink tax” is not prohibited by law in India, and there are no set government regulations on this pricing practice.

• Female-targeted goods and services prices are determined based on market dynamics and demand.

- While there is limited research on the pink tax in India, surveys indicate price variations between products for women and men.

- While there are no specific laws in India to address the issue of Pink Tax, the National Consumer Disputes Redressal Commission ruled that companies must follow fair pricing policies and avoid gender-based price discrimination.

INS Androth

Recently, the Indian Navy has received the second indigenously built anti-submarine warfare- shallow watercraft INS Andorth.

About INS Androth –

- It draws its name from Androth Island in the Lakshadweep archipelago.

- It is the second of eight anti-submarine warfare-shallow watercraft (ASW-SWC) built by

Garden Reach Shipbuilders and Engineers (GRSE), Kolkata.

- The ASW SWC ships have been indigenously designed and constructed as per the Classification Rules of Indian Register of Shipping (IRS)at GRSE, Kolkata

• Features of INS Androth —

- It is approximately 77 meters in length and it is the largest Indian Naval

- Propulsion: The ship is propelled by a diesel engine-waterjet combination, which allows for high speed and efficient manoeuvrability in shallow waters.

- Armament: It is equipped with state-of-the-art lightweight torpedoes, indigenous ASW rockets, and advanced shallow water SONAR,

- It enables effective submarine detection and engagement in littoral

- It strengthens the Navy’s Anti-submarine, coastal surveillance and mine laying

- It is built by using over 80 percent indigenous content, reflecting growing domestic capabilities and reducing dependency on imports.

INS Trikand

The maiden bilateral maritime exercise between India and Greece will be steered by the Indian Naval Ship Trikand, which was called at Salamis Bay, Greece, during her ongoing deployment to the Mediterranean Sea recently.

About INS Trikand –

- It is a Talwar-class guided-missile frigate of the Indian

- It is the third and final ship of the second batch of Talwar-class frigates ordered by the Indian

• It was built by the Yantar shipyard in Kaliningrad, Russia.

- It was commissioned into the Indian Navy on 29 June 2013 at Kaliningrad,

- It is part of the Indian Navy’s Western Fleet and operates under the Western Naval Command headquartered at Mumbai.

• Features —

- INS Trikand carries a state-of-the-art combat suite, which includes the supersonic BRAHMOS missile system, advanced surface-to-air missiles Shtil, an upgraded A190

medium-range gun, electro-optical 30 mm close-in weapon system, anti-submarine weapons such as torpedoes and rockets, and an advanced electronic warfare system.

- The weapons and sensors are integrated through a Combat Management System ‘Trebovanie-M’, which enables the ship to simultaneously neutralise multiple surface, sub- surface, and air threats.

- Powered by four gas turbines, INS Trikand is capable of speeds more than 30 knots and is

configured to carry a Kamov 31 helicopter.

- It has a complement of about 300 personnel, including

Zircon Missile

Russia recently said that it had fired a Zircon (Tsirkon) hypersonic cruise missile at a target in the Barents Sea.

About Zircon Missile –

- The 3M22 Zircon (Tsirkon), NATO code-named SS-N-33, is a scramjet-powered hypersonic cruise missile developed by Russia.

- Initially designed to target naval assets, the missile has evolved to include land-attack capabilities, making it an important tool for precision strike missions.

- It entered service in 2022, with initial deployments on Project 22350 Admiral Gorshkov-class

• Features —

- It has an estimated length of 9 meters (30 feet) and a diameter of 60 cm (24 inches), with an estimated weight of between 3,000 and 4,000 kg (3–4 tons).

- The missile is powered by a two-stage propulsion

- The first stage consists of a booster engine powered by solid fuel, which accelerates the missile to supersonic speeds.

• After reaching a certain speed, the scramjet engine in the second stage ignites,

utilising liquid fuel to accelerate the missile to hypersonic speeds.

- Its speed—reaching up to Mach 9—makes it extremely difficult to

- The operational range of the Zircon is reported to be around 400–450 km (250–280 miles) at low altitudes, while it can extend up to 1,000 km (620 miles) in a semi-ballistic

- It is capable of carrying both conventional and nuclear warheads, providing it with a versatile role in modern warfare.

- The missile uses a combination of inertial navigation, radar homing, and plasma stealth

to navigate towards its target.

- One of the key features of the Zircon is its ability to generate a plasma cloud during hypersonic flight, which absorbs radio waves and makes the missile more difficult to detect by radar. This phenomenon is known as plasma stealth.

Dongsha Islands

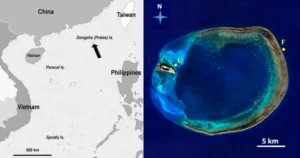

Taiwan’s Coast Guard Administration (CGA) confirmed recently that it had dispatched vessels to repel both a Chinese coast guard ship and a Chinese fishing boat operating near Dongsha Island.

About Dongsha Islands –

- The Dongsha Islands, also known as the Pratas Islands, are a small group of three islands

located in the northern part of the South China Sea.

- It lies approximately 445 km southwest of Kaohsiung, Taiwan, and 320 km southeast of Hong Kong.

- The Dongsha Islands are governed by Taiwan. There are no permanent But

Taiwanese marines are stationed

- These islands are characterised by a circular coral atoll

- They are composed primarily of clastic coral and reef flats approximately 15 miles (24 kilometers) in diameter, enclosing a lagoon about 10 miles (16 kilometers) in diameter.

- The island group includes Dongsha Island, being the only island above sea level, about 1 mile (1.6 kilometers) long and a little over 0.5 miles (0.8 kilometers) wide, and Northern Vereker and Southern Vereker atolls, both of which are below sea level.

Garra nambashiensis

Researchers recently discovered a new species of freshwater fish, Garra nambashiensis, in Manipur.

About Garra nambashiensis –

- It is a new species of freshwater fish which belongs to the Labeonine

- It was discovered in Taretlok, a tributary of the Chindwin River, near Nambashi Valley in

Manipur’s Kamjong district.

- It was collected from “swift-flowing riffles (shallow sections of a river or stream) with algae- covered gravel beds and mixed substrate comprising cobbles, boulders, pebbles, sand, fine silt, and coarse sediments.

- The species features a quadrate-shaped proboscis, 7-8 acanthoid tubercles on the anterolateral margin, black spots on the opercle, 8-11 dorsal-fin scales, and six black stripes extending to the hypural plate.

- It typically measures 90-140 mm (9-14 cm), and locals call it

- Currently, 60 species of Garra have been recorded from various river systems in the Northeast, encompassing the Eastern Himalayan and Indo-Burma regions.

- Of these, 32 are grouped in the ‘proboscis species group’ and occur in the Chindwin, Brahmaputra, Barak, and Kaladan river systems.

- Eight species have been recorded from the Chindwin river system alone, including the recently described G. chingaiensis.

Source: The Hindu

Daily Current Affairs 16th September 2025 MCQs

1. Consider the following statements regarding Article 143 of the Indian Constitution –

- Under Article 143, the President can refer any question of law or fact, including hypothetical questions, to the Supreme Court for its opinion.

- The Supreme Court is bound to provide an opinion on every reference made by the President under Article 143.

- The advisory opinion given by the Supreme Court under Article 143 is binding on all courts and authorities in India.

Which of the statements given above is/are correct?

- 1 only

- 1 and 2 only

- 2 and 3 only

- None of the above

Answer – A

Explanation – The advisory jurisdiction is provided under Article 143 of the Constitution. It extends the Government of India Act, 1935 provision to include both questions of law and fact, including hypotheticals. The President may refer a question that “has arisen, or is likely to arise”, It must be of public importance and require the Supreme Court’s opinion. Usage History — This power has been used at least 15 times since 1950. Supreme Court’s Discretion in Responding to Presidential References – Discretionary Nature of Article 143(1) — Article 143(1) states the Supreme Court “may” report its opinion, indicating that the Court has the discretion to decline a reference. The SC has declined at least two such references in the past. Notable Cases Where the SC Declined — 1993 – Ram Janma Bhumi-Babri Masjid Reference — President Shankar Dayal Sharma asked whether a Hindu temple or religious structure existed before the Babri Masjid. The SC unanimously declined to answer as the matter was already sub judice in a civil suit. 1982 – Jammu & Kashmir Resettlement Law Reference — President Giani Zail Singh referred the constitutionality of a Bill on the resettlement of people who migrated to Pakistan. The SC did not

return an opinion as: The Bill was enacted after being passed a second time and assented to by the Governor. Petitions challenging the law were already pending before the Court. Since advisory opinions are not binding, the Court would have to decide the issue afresh in regular litigation. Key Insight — The advisory opinion under Article 143 is non-binding and not a substitute for judicial review. The Court may refuse to answer if the issue is already in court, violates constitutional principles, or becomes irrelevant.

2. Consider the following statements regarding ‘White Goods’ —

- White Goods refer to large household appliances such as refrigerators, washing machines, and air conditioners.

- The term originally referred to products with white enamel

- White Goods are exempt from Goods and Services Tax (GST) in

Which of the statements given above is/are correct?

- 1 only

- 1 and 2 only

- 2 and 3 only

- All of the above

Answer – B

Explanation — White Goods indeed refer to large household appliances such as refrigerators, washing machines, and air conditioners. The term originally referred to products with white enamel finishes, which is true. However, White Goods are not exempt from Goods and Services Tax (GST) in India. They are typically taxed at higher GST rates due to their non-essential nature.

3. Which of the following statement(s) is/are not correct?

- Koalas are the species which inhabit parts of Australia for at least 25 million

- Thirty-two species of Koalas are found in the

- Recently, the Australian government has declared Koalas as ‘vulnerable’ species, owing to widespread habitat loss.

Select the correct codes from below –

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- All of the above

Answer – B

Explanation – Australian government has upgraded the conservation status of the Koalas from ‘vulnerable’ to ‘endangered’ in Queensland, New South Wales and the Australian Capital Territory, based on the recommendation of the threatened species scientific committee.

The impact of prolonged drought, followed by the black summer bushfires, and the cumulative impacts of disease, urbanisation and habitat loss over the past twenty years have led to the advice. Another major threat is the spread of chlamydia, a sexually transmitted disease known to cause blindness and cysts in the koalas reproductive tract.

Koala species have inhabited parts of Australia for at least 25 million years. But today, only one species remains — the Phascolarctos cinereus. They are found in the wild in the southeast and eastern sides of Australia — in coastal Queensland, New South Wales, South Australia and Victoria.

4. Consider the following statements regarding the ‘Pink Tax’ –

- It is a government-imposed tax specifically on products consumed by

- It leads to a situation where products marketed towards women are often priced higher than similar products for men.

- In India, there is a specific law that explicitly prohibits the practice of gender-based price discrimination known as the Pink Tax.

Which of the statements given above is/are correct?

- 1 only

- 2 only

- 2 and 3 only

- All of the above

Answer – B

Explanation – The Pink tax is neither a real tax nor is it a government-imposed fee. It is a term used to describe the extra cost that some companies charge for products marketed to women compared to similar products marketed to men. This means women might end up spending more money for the same product that men get for less. When companies charge more for pink (female) products compared to blue (male) versions, the extra revenue does not go to the government but benefits the companies Pink toys, haircuts, dry cleaning, razors, shampoos, body lotions, deodorants, facial care, skincare items, beauty care, clothing, T-shirts, jeans, salon services ,etc. suffer the tax. The term “Pink Tax” is believed to have originated in the U.S. in California in 1994. It emerged following the realisation that brands in various cities consistently charged women higher prices for goods and services than men. As per a study done in the U.S., personal care products targeting women were 13% costlier than men’s. Further, women’s accessories and adult clothing were 7% and 8% more expensive. Pink Tax in India — The “pink tax” is not prohibited by law in India, and there are no set government regulations on this pricing practice. Female-targeted goods and services prices are determined based on market dynamics and demand. While there is limited research on the pink tax in India, surveys indicate price variations between products for women and men. While there are no specific laws in India to address the issue of Pink Tax, the National Consumer Disputes Redressal Commission ruled that companies must follow fair pricing policies and avoid gender-based price discrimination.

5. Which of the following statement(s) is/are correct?

- Zircon is a hypersonic ballistic missile recently tested by the Russian federation to add into the country’s arsenal of weapons called ‘invincible’.

- A hypersonic speed is any speed that is more than six times the speed of the

Select the correct codes from below –

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Answer – D

Explanation – Russia carried out another successful test of its Zircon hypersonic cruise missile, one the latest additions to the country’s arsenal of weapons called “invincible” by President Vladimir Putin. A hypersonic delivery system is essentially a ballistic or cruise missile that can fly for long distances and at speeds higher than 5 Mach (5-10) at lower altitudes. This allows it to evade interception from current Ballistic Missile Defence (BMD). It can also execute a high degree of manoeuvres.

Also read Daily Current Affairs – 15 September 2025 | Top News